All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

On March 30, 2023, Vior announced the closing of a non-brokered flow through financing for gross proceeds of C$2.5M. 5M FT shares were issued at C$0.2975 for critical minerals exploration (the CMETC Offering), and 3.88M FT shares at C$0.2575 for flow-through mining expenditures (the METC Offering). This was a solid vote of confidence by Osisko Mining, which took up almost 80% of this financing, and will own a 13.63% undiluted interest now. It was also good to see there were no warrants, and a significant FT premium (60-86%) to go with this. CEO Mark Fedosiewich was obviously pleased with this raise:

"We are delighted with Osisko's significant participation in this offering. It confirms their strong commitment and shared vision as a long-term investor in Vior. The support and investment from this highly respected mining company is a strong endorsement of both our team and the quality and scale of projects that we have assembled. This financing will allow Vior to accelerate its overall exploration programs, with an emphasis on our Belleterre Gold and Lithium projects in Quebec."

According to CEO Fedosiewich, C$1M will be assigned to the Belleterre gold project, and C$1.5M to the lithium targets at the Belleterre lithium project. In addition, Vior through its option partner SOQUEM, is looking to spend C$1.5M at the Skyfall Nickel project this year.

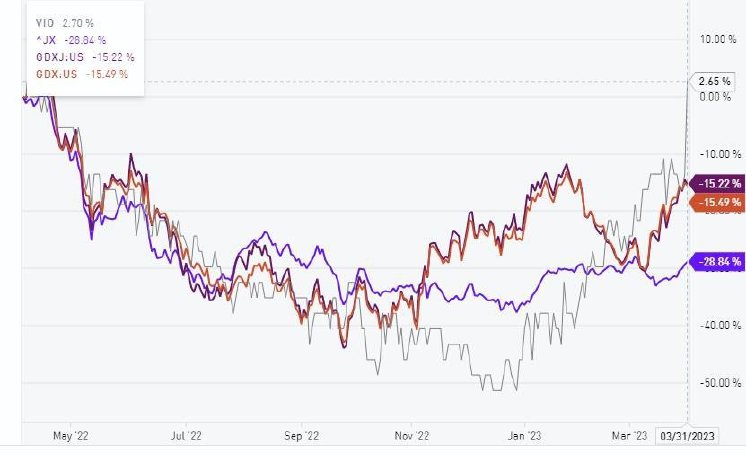

The share price of Vior has been recovering the last few months, in some sort of a delayed lockstep mix with the junior market and the gold stock ETFs itself, eventually outscoring the indices on the recent financing news:

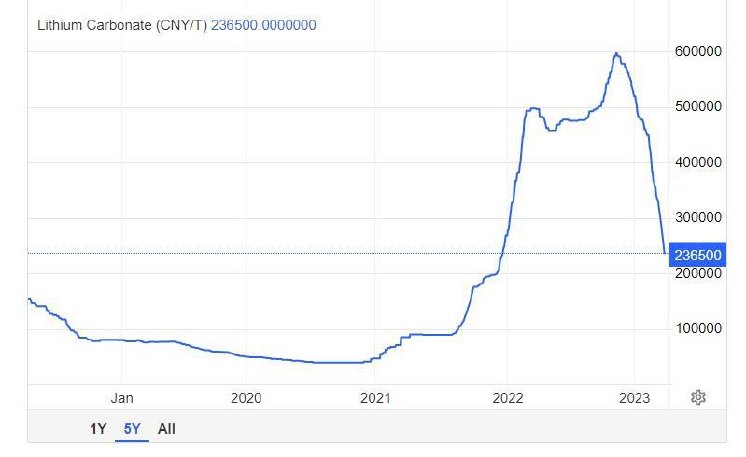

With gold doing well, which is important as Vior’s flagship project is the Belleterre gold project, lithium product prices on the other hand aren’t cooperating as much:

The reason it dropped considerably below normal, overheated profit-taking levels (350,000-400,000Y/t) is three-fold. As the Chinese government halted subsidies and cash grants, demand for EVs in China crashed. At the same time, battery producers produced much more than needed before the subsidies ended, just to profit from these same subsidies, but this caused a huge inventory, which is being sold off now at discounts, causing lots of production capacity to be switched off, in turn minimizing demand for lithium products. On the other hand, there is a “car war” going on now in China, as combustion engine cars are being cheaper now than unsubsidized EV’s, putting even more strain on EV demand.

A bit more hypothetical reason is the forecast of supply increases up to 30% for this year, which I don’t really buy as earlier expansions took much longer than anticipated. I must say that I found this entire Chinese market dynamic very artificial, as it was well known in advance that subsidies etc would be halted. Another interesting development in this regard is the support at the 250,000Y/t levels, initiated by a price floor, reportedly set by the major Chinese producers on March 31, 2023, although vehemently denied by major producer Ganfeng, also present at the same conference where this price floor reportedly was arranged. By abruptly halting subsidies this way, it seems China provided the entire Chinese lithium/EV industry a considerable setback, at least temporary. My take is, that the Chinese economy needs to work through the self-created oversupply, and this could take one or two quarters, after this demand should pick up again.

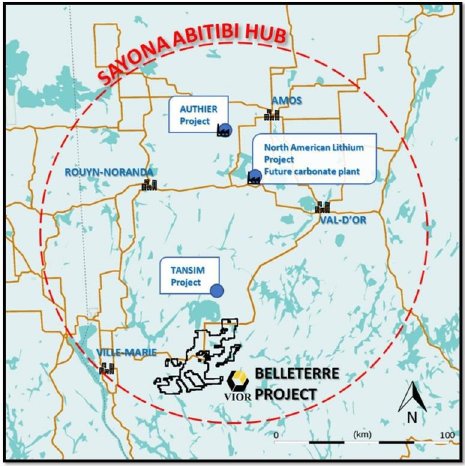

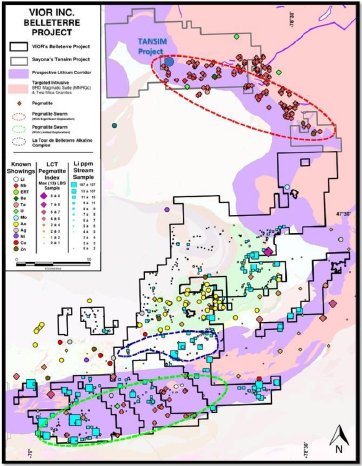

Vior should be ready for this timeline, as they have a project with lithium potential now, after expanding their Belleterre project with their promising district-scale lithium claims package. Although known for its historic high-grade gold production, the Belleterre region is also recognized for its lithium endowment with economic grades drilled at the advanced Tansim Lithium Project, located 20km north of Vior’s property, like for example 12.35m @ 1.29% Li2O and 43.7m @ 0.82% Li2O. Owned by Sayona Mining (ASX:SYA, market cap of A$2.3B), aiming at production in March 2023, the Tansim project is part of Sayona’s Abitibi Hub strategy that includes the Authier resource (87.8Mt @ 1.05% Li2O M&I) and other advanced production assets (mine, concentrator, plant):

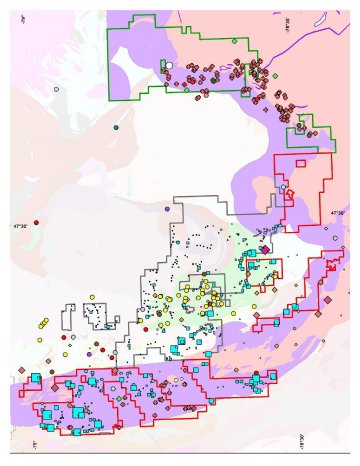

Vior completed an extensive regional reconnaissance exploration program in and around its Belleterre Gold project, and after identifying the lithium-bearing pegmatite potential, management set out immediately and staked 466 additional claims in the area, covering over 268.2km2, to get as much prospective ground as possible. The new claims are shown in red:

Since the little red crosses represent pegmatite showings (and the blue squares indicate lithium sampling results as can be seen at the next map), it will be clear the Vior team identified multiple high-potential targets for lithium-bearing pegmatites:

Vior is planning an aggressive late Spring/Summer field exploration program for its lithium potential, and if successful, an initial drill program could commence this Fall.

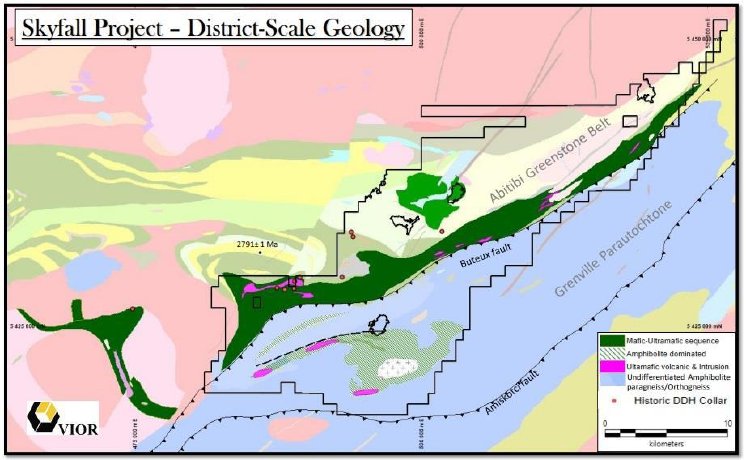

Vior’s second project is the Skyfall nickel project, which encompasses a large, district-size land package of 515km2. The company is about to complete a 3,636km line VTEM over the entire property, with results expected late April, 2023.

The company will begin an extensive Spring/Summer 2023 field exploration program at Skyfall, and if successful, will initiate a preliminary drill program in Fall 2023.

After the closing of the recent financing, Vior has approximately C$4.1M in the treasury, and almost C$1M in marketable securities, so the company is cashed up sufficiently to fund their third drill program at Belleterre for gold, beginning Fall 2023 once all drill targeting and initial permitting has been completed. Management is aiming for a significant drill program of approximately 30,000m for Belleterre Gold, extending well into 2024.

Conclusion

Not many people could foresee what a mess the Chinese would create at their EV market, with significant fallout to lithium product prices. However, the EV paradigm shift is here to stay, and I’m expecting China to chew through 3-6 months of battery stockpiles, after which markets likely will normalize. By that time, Vior could have pretty interesting exploration results on its Belleterre gold and lithium project, funded by the recently raised C$2.5M flow-through. With a little luck the gold price could have finally and convincingly broken the US$2,000/oz threshold again, creating a two-way runway for a re-rating. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Vior Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.vior.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.