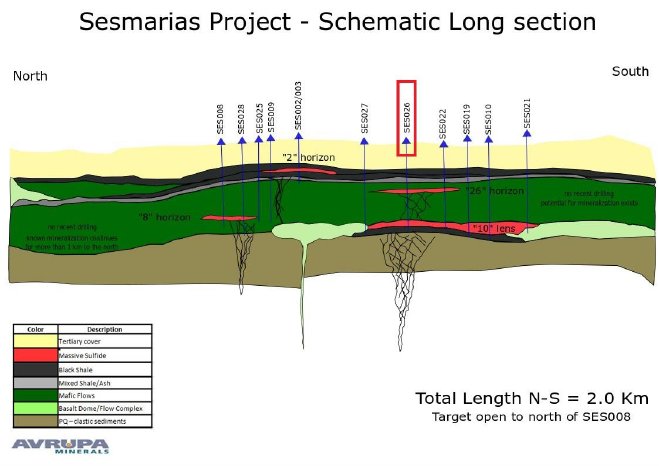

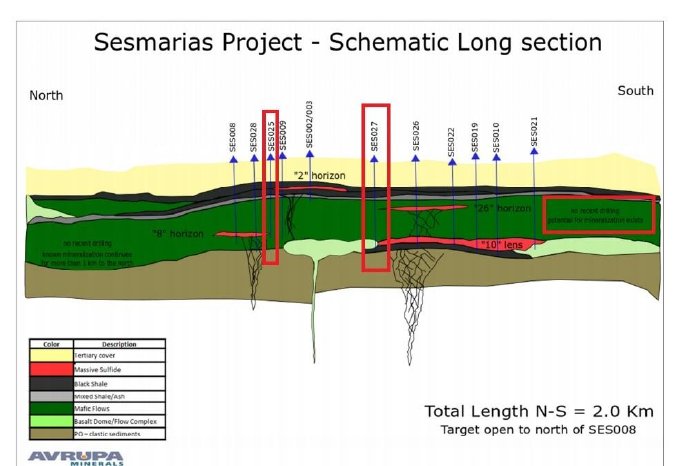

The 10 Horizon as defined on this map from the February 11, 2019 news release has been promoted to the 10 Lens now, as sufficient drill results have been obtained so far. Management also provided investors with a schematic long section in the same news release, which is a conceptual drawing of geology and mineralized bodies:

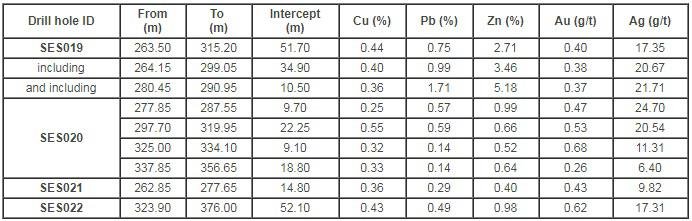

Highlights from the program include the following results according to the latest March 11, 2019 news release:

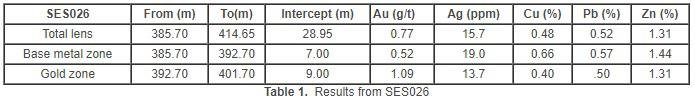

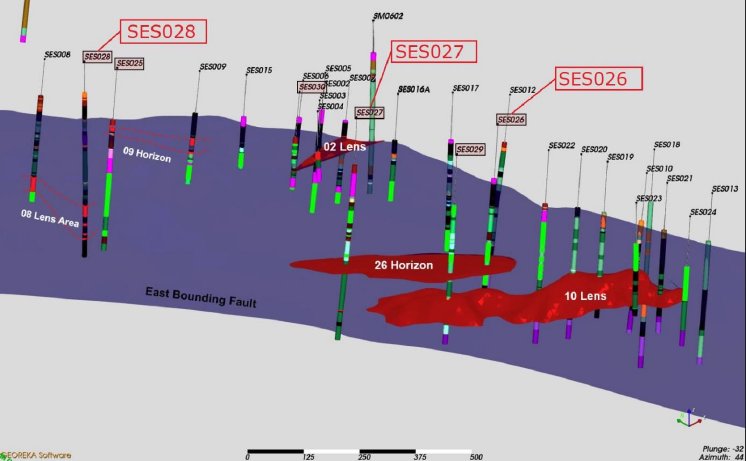

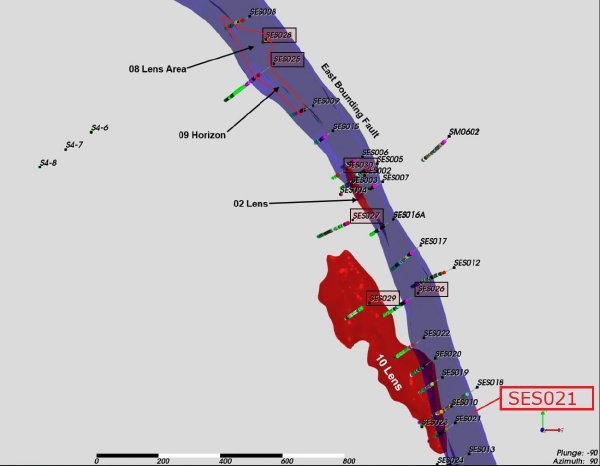

- SES026 intercepted 28.95 meters of 0.48% copper, 0.77 g/t gold, 15.7 ppm silver, 0.52% lead and 1.31% zinc, and extended the 10 Lens by 300 meters to the north from previous drilling.

- The 10 Lens is now at 600 meters x 300 meters x 25 meters. Mise-à-la-masse (MALM) geophysical anomalism extends another 150 meters past SES026 location.

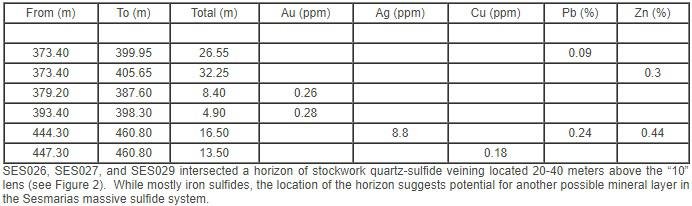

- Discovered a possible new mineralized horizon in SES026, located above the 10 Lens, and intersected it again in SES027 and SES029.

- SES028 intercepted the edge of a significant feeder zone stockwork beneath the 8 Lens. Assays indicated anomalous gold, silver, copper, lead, and zinc throughout the entire length of the stockwork from 373.40 meters to 460.80 meters in depth, beneath the 8 Lens.

- Confirmed that the high grade 2 Lens is a fault-bounded fragment of massive sulfide mineralization with origin yet to be determined. Hole SES003, drilled previously on this target, is now also being assayed and will be reported shortly.

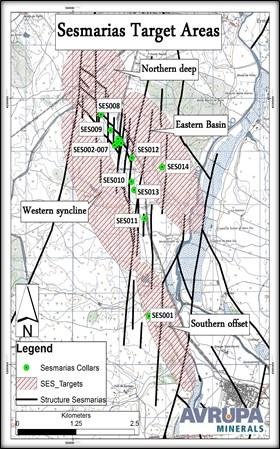

- Continued re-logging of historic drill holes has upgraded targets in the northern portions of the Sesmarias Prospect.

- Each hole drilled in this exploration phase of the Project has enhanced the revamping of the exploration model. Combined with strong assay results in SES026, in particular, the information will be used in the next drill targeting exercise for this large area.

By revamping the exploration model, management means to describe that the current drill results had a profound impact on the understanding of the structural geology of Sesmarias. It appeared that the stratigraphy (complex of layers), especially the orientation of the various layers and mineralized zones, was different from previously understood. As Sesmarias has a pretty complex geology, with lots of faults, folds and potentially folded folds, it was hard to determine the structural controls of any mineralized zone perpendicular on the strike directions. According to the geologists, this area has been deformed several times in the past 360 million years, so this makes determining the linears (directions in different dimensions) very difficult at times. By simplifying everything to layers (rock material of the same character, which is much easier to visualize than anything else) and then trying to connect the same layer between drill holes, they found it easier to construct a pretty good subsurface geological map.

As it turned out, the orientation of the discovered lenses changed from predominantly sub-vertical to relatively horizontal because of new insights. I wondered how this process actually materialized for the geologists, and had a few follow-up questions as well. Fortunately management went out of their way to provide me with pretty extensive answers and explanations, to make sure yours truly, but also the audience would understand what the exploration program at Sesmarias is all about. Here we go:

“The change in “attitude” (orientation!) came about because we stepped away from the details of rock layers and re-grouped layers into packages of layers with similar characteristics. We were able to follow packages of layers from drill hole to drill hole, over 100’s of meters of distance, and we began to see uniformity of the layers around the area between the bounding fault on the east side of the main Sesmarias target area and the area towards the west where the layer packages are in contact with the Tertiary gravels and sediments. When we first saw the rocks, we were quite sure that the thin, well-folded units we observed were really and truly folded layers of rocks. However, now we realize that those folds may not actually be folded layers, but folded structural attributes (meaning more abstract comprehensions like axis or intersections). Basically we probably could not see the forest for the trees.

So, by following these packages from hole to hole, we (mostly meaning our geo Josh Coder) began to build a geological model using a 3D modeling program called GeoReka. By building the model, we began to see more regularity in the rocks, allowing more predictability in our mineralization. The layers generally dip to the east at 30-45 degrees, and plunge to the north. This means our target appears to dip to the northeast until it is stopped by a high-angle fault, which in-house we call the Joana Fault. The Joana Fault does not run in a straight line, so this is a bit of a complication, but we do know now why some of our holes drilled with both Antofagasta and Colt (previous JV partners) did not hit mineralization.

For now, this fault is limiting mineralization on its west side. This will hopefully change when we do more drilling east of this particular fault. Right now, we think the rock units/layers have been down-dropped on the east side of the fault, but this is only based on limited information from 2-3 holes drilled further away to the east. One of those holes was our own SES014, which we now think may have been stopped short (we actually thought the same when we drilled it, but we had a lot less knowledge back then). In any case, there is an off-hole geophysical conductor in SES014, which we have described as our eastern basin target.”

As hole SES014 is located quite a bit to the east and away from the big fault, I was wondering why management thought there could be mineralization present, also considering the different rock types over there which usually don’t contain mineralization based on earlier results, despite all potential vertical and lateral displacements. They had this to say:

“When talking about having more chance to the east, we meant just across the fault. There is a chance over there because of the potential downdrop (vertical movement), compared to the west side of the fault. That means the target rocks/layers are deeper, though certainly possibility of horizontal movement exists, as well.”

Again as a reminder, Sesmarias contains a large amount of faults and off-setting structures, constructing an interesting puzzle from a geological standpoint.

Management elaborates further on their exploration plan:

“The re-interpretation of the orientation of layers gives us a lot of license to re-orient the mineralization, as it is basically just another bed/layer. SES026 targeted the “extension” of the layer, successfully intersecting massive sulfide mineralization. SES027 was less successful, as it intersected weak mineralization and mafic intrusive rocks, which may represent the source of the mineralization. We are thinking that the mafic rocks represent part of an intrusional dome, right now with known mineralization to the south of it. We do not know yet if there is further mineralization on the north side of the dome, as portrayed in the long section further below.

So we estimate a potential strike length of somewhere between 600 and 900 meters of massive sulfide mineralization, which stops somewhere between holes 26 and 27. The new, more horizontal positioning of the massive sulfide allows for a much bigger target at shallower depth, where the more vertical positioning gives a target of the same shape, but gets very deep, very quickly.”

Therefore I view this adjusted orientation as a positive, as it saves drilling budget. On my question if cross sections could be provided anytime soon, management answered they needed some more drilling in order to get sufficient understanding of continuity. They added:

“Right now, 2, 8, and 26 are more horizons than actual masses, and presumably smaller than the 10 Lens. Horizon 2 appears to be small, though high grade (SES002), and it is open to the south. We have seen traces of Horizon 26 in 3-4 holes now, and it is presently manifested by strong stockwork to semi-massive sulfide material. We think that there is a possibility that Horizon 8 could be an extension of the 10 Lens, because it is roughly at same depth, and horizontal displacement of surrounding packages through faults checks out with this concept. Horizon 8 could have its own feeder source as it is on the other side of this basalt dome, as both Horizon 8 and the 10 Lens are roughly parallel to each other and to stratigraphy. More drilling is necessary to figure this all out.”

Looking at the schematic long section again, I noticed that 025 and 027 missed the massive sulphide lenses. It made me wonder if by more vertical faulting/displacements there could be (off set) extensions of the lenses/horizons, or these basalt domes could be structurally consistent and not broken up/displaced by faults, limiting mineralized potential in these areas except for stockwork (027)? To what extent could this stockwork be useful/economic? Management had this to say:

“SES025 “hit” the 2 Lens at predicted depth, but it was very thin (<10 cm). This probably has something to do with vagaries in location of the Joana Fault.

There is still plenty of opportunity for faulting to displace/move/disrupt/extend the mineral potential. We do need more drilling to be able to ascertain that. Sometimes, the stockwork mineralization is even better than the massive sulfide mineralization. While we have encountered a long intercept of stockwork mineralization, it is probably the edge of the feeder zone. Sometimes, if there is gold in the system, the stockwork can actually carry economic gold grades.

For a number of years, back in the 1990’s I believe, a large stockwork zone at the Rio Tinto Mine in Spain was mined for its gold. Now, of course, Rio Tinto is back in business as a copper mine. I believe they mine both massive ore and stockwork ore at RT. Same at Neves Corvo. Stockwork mineralization can be economic for base metals and precious metals, depending on what metals are in the system. Using Neves Corvo as an example, I understand that some of the stockwork zones can be much higher grade in base metals, but perhaps there is more waste rock.”

For now it the stockwork mineralization doesn’t generate economic results, but it is still early days of course. On a different note, to me the targets between Lousal and Caveira have always been very interesting as well, as the historic resource of Lousal seems an easy target. I initially thought of the Lousal historic resource as a relatively advanced project, which might be relatively easy to prove up by 15-30% verification drilling (depending on quality of historic drill data of course) to get it to 43-101. Management had this to say about this topic:

“Lousal is an interesting target for sure. Unfortunately, its hard to find potential partners who wish to do greenfields exploration or “light” brownfields work, as most companies are after high cost, low quality, “advanced” projects out on the market. Exploration is not always viewed as an inexpensive way to get into a valuable project. It always comes down to available funds. If you are on a really good exploration project, and you keep getting good results, you can move quickly. For now we had to prioritize, and picked Sesmarias first.”

After this little Q&A on geology, I wanted to know a bit more about their exploration plans. Therefore I wanted to know how many meters they are going to drill at Sesmarias in how many holes at what drilling cost per meter all-in, when this will start and if they have schematic sections of the old Lousal resource and the other targets based on historic drilling. Besides this, I was also curious about their drilling strategy if they could or would like to share. Here is their answer:

“Ideally, we would like to see minimum 10,000 meters per year for the next 2-3 years once our next level of license is approved. This was the idea with the potential partner, as we reported back in March 2018. Before we are able to drill at Lousal, we have to go over all the old work an construct a 3D model. That would be a full-time job for a computer-savvy geologist for a couple of months. In the near future, we would like to see Sesmarias, Lousal, and Monte da Bela Vista drilled to ascertain the resource potential.

Then there is the Caveira Mine area, and at least a half dozen other mineral targets that we know about already on the trend from Caveira to Aldeia dos Elvas at the southwest corner of the license. The whole idea of having a 10 million euro investment into Alvalade was to do all this, that would be 30-40 thousand meters. We estimate that US$1 million can get us 3,000+ meters of drilling, so 1 million euros can get us 3,500+ meters, all in. Thus 10 million euros is 35,000 meters or more. So, 300 euros per meter. We did this with Antofagasta in the past.”

This wraps up my little interview with management as part of this update. According to their estimates, they ideally would like to spend about US$3-4M annually on Alvalade, but as I view it, Avrupa is already on its way to their minimum economic threshold of 25Mt @1.5-1.7% CuEq just based on the results for the 10 Lens. This means with a few more good step out results they could already have a 100% owned, economic project on their hands without even tapping into JV partners, and as soon as the markets become (more) aware of this, there might very well be a share price re-rating around the corner, and further capital raises could be done at lower dilution levels in that case. With copper and zinc prices picking up again and both with good fundamentals, the Avrupa Minerals story should be able to attract more attention this year.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.