According to forecasts, institutional investors could become fonder of silver in 2023. This is because they are expected to limit their short positioning due to the strong link with the gold price. And for the gold price, many see new highs this year. But silver is also considered a "leveraged gold bet." The only question is to what extent the gold price will then pull the silver price up with it. Economic and geopolitical crises should make gold and silver shine. If the turnaround in the Fed's interest rate policy occurs, this will be another plus for precious metal prices. Of course, it is the energy turnaround in particular that will be responsible for sustained high silver demand. This area alone should strengthen the silver price. After all, more and more governments are favoring renewable energy sources and thus driving silver demand.

Significant silver demand comes from U.S. private investor demand for coins and bars. Demand for silver is also high in India. And exports of the precious metal to Canada have increased. Precious metals have then been shipped from the U.S. to Canada to serve end-user markets. More than 50 percent of silver is consumed by industry. If the manufacturing sector grows, as is generally expected, this in turn strengthens the price of silver. For the first quarter of 2024, some analysts expect the price of silver to be around US$29 per troy ounce.

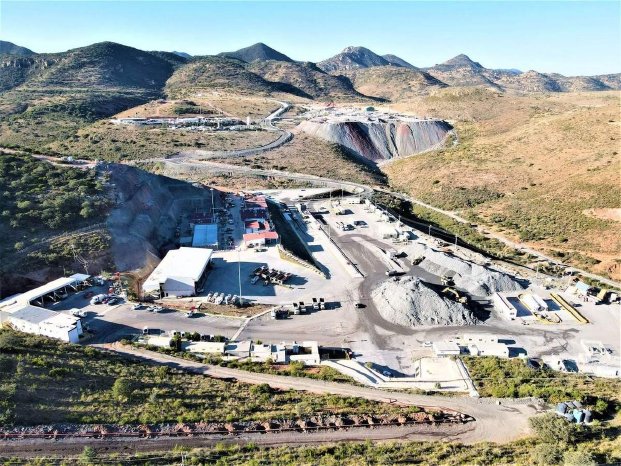

It's worth taking a look at companies with silver, for example MAG Silver - https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ -. The company has a stake in the Juanicipio silver mine in Mexico. Commercial silver production began there on June 1. Three other projects belong to MAG Silver.

Discovery Silver - https://www.commodity-tv.com/ondemand/companies/profil/discovery-silver-corp/ - is also present in Mexico, with its Cordero silver project. It is one of the world's largest silver deposits.

Current corporate information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/