Additionally, the Company is pleased to provide a multi-year outlook of its business including detailed 2021 guidance. The guidance and outlook exclude any contribution from the Didipio Gold-Copper Mine in the Philippines and the Company would provide a subsequent update to forecasts when the timing of a restart at Didipio is confirmed. The Company will host a webcast to discuss the results and outlook today and these details are provided below.

2020 Financial and Operating Highlights

- Total Recordable Injury Frequency Rate (“TRIFR”) of 3.3 per million hours worked compared to 3.6 per million hours worked at the end of 2019.

- Maintained MSCI ESG “A-rating”; released an updated statement of position on climate change with a goal to achieve net zero operational greenhouse emissions by 2050.

- Full year 2020 consolidated production was 301,675 ounces of gold including fourth quarter production of 99,155 gold ounces, a quarter on quarter increase of 57%.

- Full year All-In Sustaining Costs (“AISC”) of $1,278 per ounce on sales of 310,531 ounces of gold.

- Fourth quarter AISC of $1,080 per gold ounce sold, a 36% decrease quarter-on-quarter.

- Full year revenue of $500 million including fourth quarter revenue of $168 million.

- Full year and fourth quarter adjusted Earnings before Interest, Depreciation and Amortisation (“EBITDA”)[1] of $165 million and $70 million, respectively.

- Fourth quarter adjusted net profit of $2 million compared to an adjusted net loss of $15 million in the previous quarter.

- Full year operating cash flow of $199 million, reflecting adjusted cash flow per share of $0.22.

- New $250 million revolving credit facility with maturity date of December 31, 2024.

- Immediately available liquidity of $229 million, including $179 million of cash on hand.

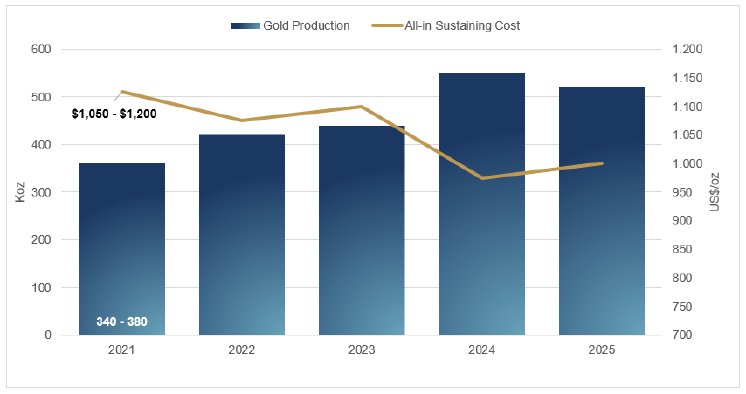

- 2021 production range of 340,000 to 380,000 gold ounces at AISC of $1,050 to $1,200 per ounce sold, reflecting an approximate 20% increase in production from 2020 at approximately 12% lower AISC.

- Increasing five-year production to over 500,000 ounces of gold with increasing margins on lower costs and decreasing expansionary capital investment.

- Strong production outlook underpinned by completion of low-cost organic growth projects in favourable jurisdictions (North America and New Zealand).

- First production from Martha Underground achieved, continuous milling expected to commence late second quarter.

- Golden Point Underground portal development advancing with first production expected in the fourth quarter and access to open pits underway to deliver on mine life extension.

- Haile Underground on-track with portal development commencing in the third quarter.

- Significant exploration programs ongoing at Waihi in New Zealand with an updated resource and prefeasibility study expected for WKP in the second half of 2021.

- Advancing our commitment to achieve net zero greenhouse emissions by 2050 from our operations by establishing interim emission targets by the end of 2021.

“Additionally, we are very excited with our exploration results at WKP as we continue to advance this world-class prospect. Based on the comprehensive plans we provided to the market last year, first production from WKP is targeted for 2026. However, in response to COVID-19 economic recovery plans, in conjunction with stakeholders we are investigating opportunities bring forward high-grade production into our five-year plan in a responsible and sustainable manner. The significant growth projects in New Zealand are expected to deliver substantial socio-economic benefits including an additional 300 new jobs for local rural communities.”

“Finally, at Didipio, we continue to work with the National Government on the renewal of the Didipio FTAA. After strong positive engagement with the Philippine Departments of Finance and Environment and Natural Resources in December, the renewal is pending re-endorsement by those Departments to the Office of the President for approval. We are committed to returning thousands of Filipinos, the majority of whom reside in the rural communities in the provinces of Nueva Vizcaya and Quirino, back to work to operate one of the most responsible mining operations globally. Didipio stands poised to provide much needed economic benefits to the local communities that are recovering from the social and economic impacts of COVID-19 and OceanaGold is committed to supporting that recovery.”

2020 Financial Results

Fourth quarter revenue increased nearly 72% quarter-on-quarter, reflecting higher gold sales from Haile and Macraes and the resumption of production at Waihi. For the full year 2020, the Company generated $500 million in revenue including $168 million in the fourth quarter. Revenue decreased year-over-year primarily due to limited sales from Didipio and lower annual production from Waihi as development of Martha Underground progressed, both partially offset by a higher average gold price received.

Fourth quarter adjusted EBITDA of $70 million increased significantly over the previous quarter reflecting stronger production from Haile and Macraes and the resumption of production at Waihi. Full year adjusted EBITDA of $165 million decreased year-over-year primarily due to the significantly reduced sales from Didipio.

Fourth quarter adjusted net profit was $2 million compared to an adjusted net loss of $15 million in the prior quarter. For the full year 2020, the Company recorded a net loss (after impairment charge) of $150 million including a net profit of approximately $4 million in the fourth quarter. The full year net loss included a pre-tax impairment charge of $80 million in relation to the uncertainty of timing of a re-start at Didipio.

Fourth quarter operating cash flows of $(1.6) million were lower quarter-on-quarter due to the unwinding of the gold prepay arrangement from earlier in the year and New Zealand income tax paid of $18 million in relation to the 2018 tax year. Annual operating cash flows of $199 million were a modest decrease year-over-year and attributable to reduced cash flows from Didipio and Waihi, partly offset by the $77 million received from the gold pre-payment arrangement.

Cash flows used in investing activities for the full year of $226 million decreased over the prior year primarily due to lower capital spend at Didipio and the sale of non-core equity investments.

For the full year 2020 and fourth quarter, cash from financing activities of $160 million and $117 million, respectively, reflects the $50 million debt drawdown under the revolving credit facility in the first quarter and proceeds of $122 million from the issuance of shares in the fourth quarter.

As at December 31, 2020, the Company had available liquidity of $229 million, including $179 million in cash and $50 million in undrawn credit on the new $250 million revolving credit facility maturing of December 31, 2024. The Company’s hedging program was fully closed out on December 31, 2020.

2021 Outlook

The Company expects to produce 340,000 to 380,000 gold ounces at AISC of $1,050 to $1,200 per ounce sold and cash costs of $750 to $850 per ounce sold. The 2021 production guidance range represents an approximate 20% increase in gold production along with a 12% decrease in AISC.

The Company will continue to invest in high-margin production growth including the development of new underground mines at Martha (Waihi), Golden Point (Macraes) and Haile while continuing to invest in the high-yielding near-mine exploration program underway.

Total capital investments for the full year are expected to be $280 to $310 million, including $165 to $185 million for growth capital and $85 to $110 million for sustaining capital.

Haile is expected to produce between 150,000 and 170,000 ounces of gold at cash costs of $750 to $850 per ounce sold and site AISC between $950 to $1,100 per ounce sold in 2021. This expanded range reflects ongoing risks related to continued uncertainty of the impact of COVID-19 in the United States and the well-above average rainfall experienced over the last few years, both of which had material adverse impacts on operations in 2020 when the operation experienced 60 lost mining days.

Haile’s 2021 production and cost ranges are based on operational plan that includes mining of 35 million to 40 million tonnes of material including 3.5 million to 4 million tonnes of ore. Approximately 60% of Haile’s 2021 production is expected in the first half of the year at correspondingly lower AISC due to mine sequencing on higher grades mined and processed. Ledbetter Phase 1 and Snake Phase 2 open pits will be the primary ore sources in the first half with concurrent pre-stripping at the Haile open pit which becomes the primary ore mining source in the second half. The 2021 mine plan is expected to increase mining faces from three at the end of 2020 to five by the second half of the year, which should allow for increased operating flexibility. The Company expects to mill between 3.6 and 3.8 million tonnes of ore in 2021 with an average head grade between 1.60 g/t and 1.70 g/t and average recoveries of 82 - 83%.

Haile’s 2021 capital program will focus on delivery of critical tailing storage facilities (“TSF”), water treatment and PAG waste cell infrastructure, while progressing development of the Horseshoe Underground Mine (“HUG”). The Company expects to invest $115 to $125 million in growth projects, approximately two-thirds of which relates to those infrastructure projects with the balance for HUG, where development is expected to begin in the second half of the year pending receipt of mining permits. Sustaining capital investments of $35 to $45 million will include pre-stripping at the Haile and Mill Zone open pits, as well as TSF lifts that support current operations.

Macraes is expected to produce between 155,000 and 165,000 ounces of gold in 2021 at cash costs of $700 to $800 per ounce sold and site AISC of $1,000 to $1,100 per ounce sold. The production profile by quarter is expected to be relatively consistent throughout 2021.

Portal development for Golden Point Underground (“GPUG”), pre-stripping of the Deepdell open pit and expansion of the Fraser’s open pits including Frasers West and Gay Tan pits all commenced at the end of the fourth quarter 2020. These projects are expected to extend the mine life at Macraes to 2028 with forecast production of 1.1 million ounces over the period. GPUG is expected to commence production in the fourth quarter of 2021 supplementing, and eventually replacing, underground production from Frasers Underground which is expected to conclude in the second half of 2022.

Macraes’ 2021 capital program is focussed on progressing the mine life extension projects mentioned above. The Company expects to invest $10 to $15 million in growth capital primarily attributable to GPUG portal development. Sustaining capital investments of between $35 and $45 million are approximately equally divided between pre-stripping at Deepdell and Frasers open pits and infrastructure-related spend to support the mine life extension projects, including TSF lifts and definition drilling.

The Company’s New Zealand dollar gold hedging program was closed out as at the end of 2020 and the Company currently has no further hedging programs in place.

Waihi is expected to produce between 35,000 and 45,000 ounces with cash costs ranging from $1,000 to $1,100 per ounce sold and site AISC ranging from $1,350 to $1,450 per ounce sold. The 2021 production profile is second-half weighted with continuous stope production from Martha Underground (“MUG”) commencing late in the second quarter, and the higher 2021 AISC reflects the associated ramp-up of the mine.

Development of MUG progressed 7,371 metres in 2020 and the Company expects continued development and ramp-up of operations over the next few years. First gold production from Martha Underground occurred at the end of 2020 with additional production in the first quarter of 2021 expected ahead of a mill shutdown to install a new SAG mill shell. Mining of Martha Underground will continue and ramp-up with ore stockpiled ahead of continuous milling starting late in the second quarter.

Waihi’s 2021 capital program reflects remaining investment on MUG development and associated infrastructure as well as the SAG mill upgrade. The Company expects to invest $40 to $50 million in growth capital attributable to MUG underground development. Sustaining capital investments of between $10 and $15 million reflect a portion of MUG development costs, resource conversion drilling and other minor projects.

Didipio is excluded from 2021 guidance, and holding costs are expected to be in the order of $1.5 million per month as the renewal process of the FTAA continues. Achieving steady state production at Didipio will be dependent on the timing of the FTAA renewal and workforce recruitment efforts. The Company will provide updated guidance when the timing of a restart at Didipio has been confirmed.

In December 2020, the Company had multiple meetings with national government officials on the FTAA renewal proposal. The Company remains hopeful that the renewal proposal will be re-endorsed and forwarded to the Office of the President (“OP”) for final approval. The Company will continue to engage with government officials and will work with stakeholders to ensure a safe restart of operations at Didipio. Detailed planning and consultation is underway for recommencement of operations subject to final approval of the FTAA renewal from the OP. The timeline for renewal remains uncertain and achieving steady state production will be dependent on the timing of the renewal and workforce recruitment efforts.

Exploration in 2021 is focussed on supporting existing operations while progressing near-mine organic growth projects. The bulk of exploration investment is allocated to the Waihi district including WKP and MUG where the Company plans to drill approximately 10,000 metres and 27,000 metres, respectively, at a total investment of $15 to $20 million. The Company expects to provide an updated resource estimate for WKP in the second half of the year that incorporates results from both the 2020 and 2021 drill programs. Beyond Waihi, the balance of exploration investment is allocated to continued infill and extensional drilling at GPUG, future underground opportunities near GPUG, open pit expansions at Macraes and underground growth opportunities at Haile.

Multi-Year Outlook

Over a five-year period ended December 31, 2025, the Company expects to produce an annual average of approximately 450,000 gold ounces with AISC averaging $1,050 per ounce sold with the commissioning of three new underground mines (MUG, GPUG and HUG) and expansion of the open pit operations at Haile and Macraes.

In New Zealand, the Company expects to ramp-up to full production at MUG in the second quarter of 2021 with annual production increasing to 90,000 to 100,000 gold ounces per year. GPUG at Macraes is expected to produce 40,000 to 50,000 gold ounces annually beginning in 2022 and supplement expansion of the Deepdell and Frasers open pits. At Haile, HUG is expected to deliver 70,000 to 90,000 gold ounces annually beginning in 2023 and both supplement and de-risk open pit production.

2021 Investor Update and 2020 Full Year Results Webcast

The Company will host its 2021 Investor Day and 2020 Full Year Results webcast at 5:00 pm on Thursday February 18, 2021 (Toronto, Eastern Standard Time) / 9:00 am on Friday February 19, 2021 (Melbourne, Australian Eastern Daylight Time).

Webcast Participants

To register, please copy and paste the link below into your browser: https://produceredition.webcasts.com/starthere.jsp?ei=1421371&tp_key=ef24d5a1a9

Teleconference Participants (required for those who wish to ask questions)

Local (toll free) dial in numbers are:

Canada & North America: 1 888 390 0546

Australia: 1 800 076 068

New Zealand: 0 800 453 421

United Kingdom: 0 800 652 2435

Switzerland: 0 800 312 635

All other countries (toll): + 1 416 764 8688

If you are unable to attend the call, a recording will be available for viewing on the Company’s website.

Authorised for release to the market by Acting Company Secretary, Chris Hansen

About OceanaGold

OceanaGold is a multinational gold producer committed to the highest standards of technical, environmental, and social performance. For 30 years, we have been contributing to excellence in our industry by delivering sustainable environmental and social outcomes for our communities, and strong returns for our shareholders. Our global exploration, development, and operating experience has created an industry-leading pipeline of organic growth opportunities and a portfolio of established operating assets including Didipio Mine in the Philippines; Macraes and Waihi operations in New Zealand; and Haile Gold Mine in the United States of America.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, achievement of guidance, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the outbreak of an infectious disease, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

www.oceanagold.com | Twitter: @OceanaGold

[1] Adjusted EBITDA has been calculated as EBITDA excluding Didipio carrying costs, gain/(loss) on undesignated hedges and impairment charge.