The more than 300-page In Gold We Trust report is world-renowned and has been named the “gold standard of all gold studies” by the Wall Street Journal. Last year's edition was downloaded more than 1.8 million times. This makes In Gold We Trust, which will be published for the 14h time this year, one of the most widely read gold studies internationally. The Chinese version of the In Gold We Trust report will be published in autumn 2020.

This year's In Gold We Trust report

can be downloaded free of charge under the following links:

Extended Version (350 pages)

Compact Version (100 pages)

The presentation of the In Gold We Trust report 2020 can be viewed athttps://events.streaming.at/20200527-en

The following topics are covered in the In Gold We Trust report 2020, among others:

- Review of the most important events in the gold market in recent months

- An analysis of the impact of the Covid-19 crisis on the price of gold

- The increasing importance of gold in times of de-dollarization

- Silver – ready to fly high?

- Gold and cryptocurrencies

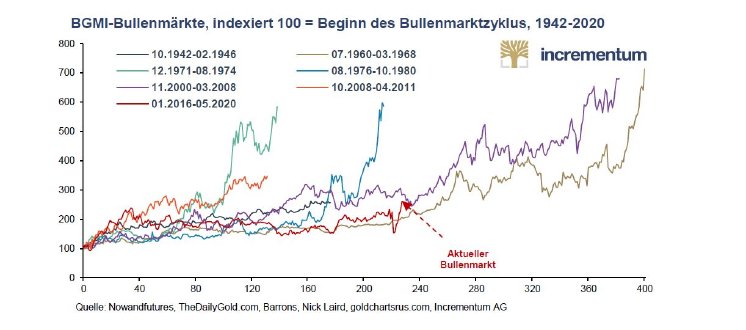

- Gold mining stocks: The bull market has started.

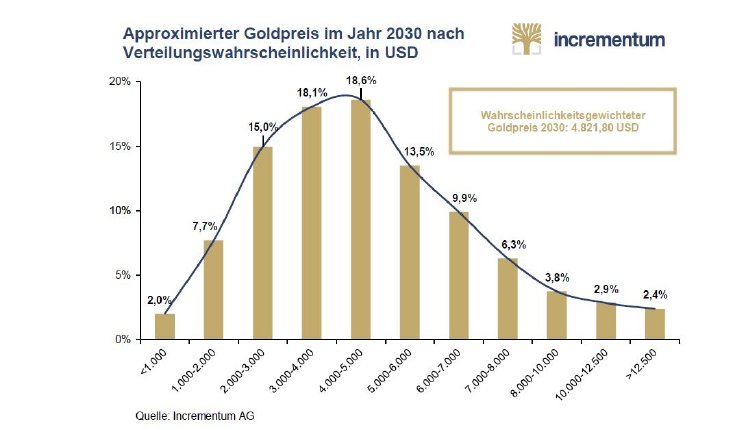

- Outlook for the gold price development in this decade: A gold price of around USD 4,800 can be expected in 10 years, even with a conservative calibration of our gold price model.

- Luke Gromen (FFTT LLC): “A Deep Dive into the Geopolitics of Oil, Gold, and Money”

- Terry Heymann (World Gold Council): “An Overview on Gold Mining Companies’ ESG Efforts”

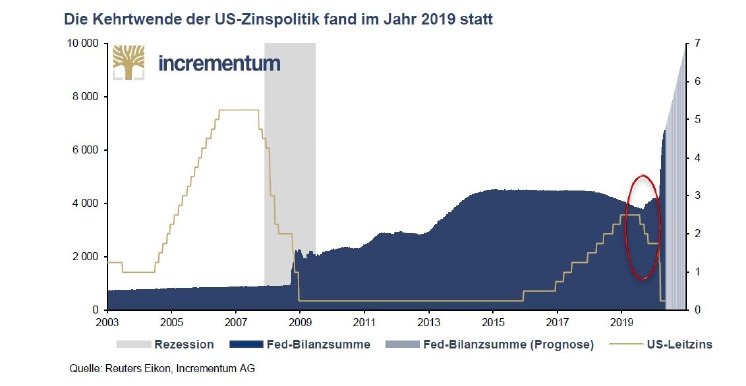

- Monetary policy normalization has failed.

We had formulated the failure of monetary policy normalization as the most likely scenario in our four-year forecast in the In Gold We Trust report 2017. Our gold price target of >USD 1,800 for January 2021 is within reach. - The coronavirus is the accelerant of the overdue recession.We are currently experiencing the most pronounced economic contraction in 90 years. The debt-driven expansion in the US has been cooling off since the end of 2018, and gold analysts had already warned of darkening recession clouds last year. Measured in gold, the US equity market reached its peak more than 18 months ago. Covid-19 and the reactions to it act as a massive accelerant.

- Deflationary forces are currently strong.

- Central banks are in a quandary when it comes to combating future inflation. Due to overindebtedness, it will not be possible to combat nascent inflation with substantial interest rate increases. Real interest rates will remain negative over the long term, which should provide an excellent foundation for further rises in the gold price. In the medium-term inflationary environment, silver and mining stocks will also be profitable alongside gold.

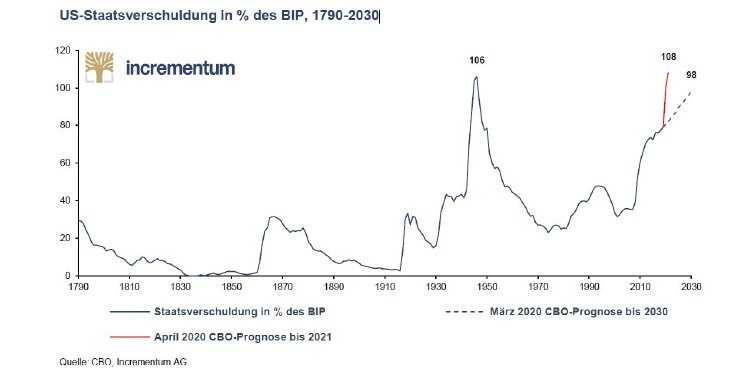

- Debt-bearing capacity is reaching its limits.The interventions to combat the pandemic are overstretching the debt sustainability of many countries. Government bonds will increasingly be called into question as a safe haven. Gold could take on this role.

- Dawn of a new monetary world orderIn the decade that has just begun, trend-setting monetary and geopolitical upheavals are to be expected. Gold will once again play an important role in the new monetary world order as a stateless reserve currency.

- New gold all-time highs are only a matter of time.The question is not whether the gold price in USD will reach a new all-time high, but how high this will be. The authors are convinced that gold will prove to be a profitable investment over the course of this decade and will provide stability and security in any portfolio.

- The authors' proprietary valuation model shows a gold price of USD 4,800 at the end of this decade, even with conservative calibration.

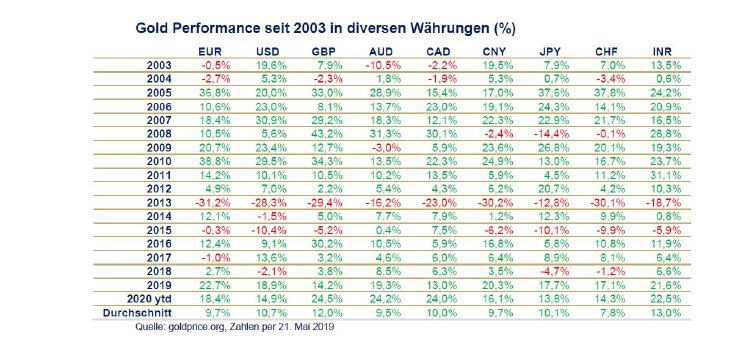

Gold rose significantly in 2019 and also since the beginning of the year 2020.

“Gold is on everyone's lips again; we are now in a new phase of the bull market”, said Stoeferle at the press conference. In every currency – except the USD – gold is currently close to or at a new all-time high. On a US dollar basis, gold rallied 18.9% last year, and since the beginning of the year the increase has been 14.9%. On a euro basis the respective figures are 22.7% for 2019 and 18.4% year to date. The gold bull market started long before the Corona crisis. Since the outbreak of the pandemic, interest in gold has been increasing. ETFs have seen record inflows, and renowned investors such as Paul Tudor Jones and Ray Dalio (re)discovered their penchant for gold. The In Gold We Trust report gets to the bottom of the most important factors influencing the gold price with its usual detailed analysis and concludes: “All roads lead to gold”, says Mark Valek.

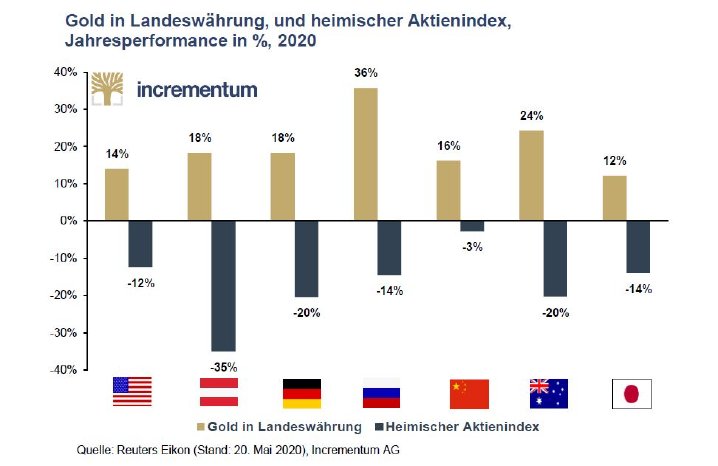

Gold leaves the stock market (far) behind in 2020.

In the course of the Covid-19 crisis, gold has proved its role as a portfolio hedge and has been able to compensate for the severe losses on the stock market. Gold has also proved once again its role as a recession hedge, according to Valek and Stoeferle.

Gold and the Covid-19 pandemic

The question that now occupies every gold-interested person is, how does the Covid-19 pandemic affect the price of gold? One consequence: National debt levels are increasing dramatically. “With the Covid-19 pandemic, fiscal discipline was lost in the vast majority of countries. In the United States, the budgetary situation has already been worrying in recent years. But now all the levees are bursting. The financing of deficits through the digital printing press creates an excellent environment for gold,” says Ronald-Peter Stoeferle.

Bleak economic outlook – not only because of Covid-19

In order to be able to assess the further course of the economy, it is important to note that it was already weakening significantly before the outbreak of the pandemic. “We must not forget,” said Mark Valek, “that the Federal Reserve had already cut interest rates three times in the second half of 2019 and resumed its quantitative easing program.”

“The European Central Bank,” Valek continues, “had already decided in September 2019 to resume its QE program in November. Economic data worldwide deteriorated significantly in the course of 2019.”

Covid-19 has acted like a powerful accelerant, but the problems of the world economy, especially in the West, are much deeper. Even though the recession will technically be over quite quickly, a rapid recovery of the economy back to pre-crisis levels is highly unlikely. This is true on one hand because the economic engine had already started to stutter significantly in 2019, and on the other because people’s behavior will change permanently in the wake of the pandemic.

Incrementum Inflation Signal points to rising inflation – stagflation ahead?

The omens for a turnaround in the inflation trend have changed fundamentally, partly because commodities – especially oil – are at a much lower price level. The Incrementum Inflation Signal indicates rising inflation rates and could soon reach its full amplitude

Stagflation appears to be a realistic scenario because rising price inflation coupled with a fading post-coronavirus economy would be the perfect setup for gold.

Other key messages from the In Gold We Trust report 2020:

Silver: Silver could see stronger price gains than gold, which would push the gold-to-silver ratio (GSR) down significantly from its present historic highs. The report goes into detail on the most important developments in the supply and demand situation for silver and analyses as well as essential future price drivers.

Mining stocks: The four-year bear market has meant that a large proportion of mining companies are now on a more solid foundation. Low energy prices and a strong US dollar against weak local currencies provide further tailwinds. From a relative perspective, dividend policy could become increasingly important. On the US equity market, more companies have suspended or cancelled their dividends in 2020 than in the last 10 years combined, while Yamana Gold (+25%), Newmont Mining (+79%), and B2Gold (+100%), for example, have recently increased their dividends significantly. This is a clear indication of the increasing profitability of mining companies.

Quo vadis, aurum?

“According to our gold price model, which is based on the two parameters of money supply development and implicit gold coverage, a gold price of around USD 4,800 is likely at the end of the decade,” explains Mark Valek. In total, three scenarios of money supply development until 2030 were weighted by probability of occurrence. The distribution of the gold price is clearly skewed to the right, making higher prices far more likely than lower ones.

“Due to the macroeconomic situation, especially global debt and negative real interest rates as well as the expected monetary experiments like MMT etc., the 2020s will be a golden decade,” says Ronald-Peter Stoeferle.

A technical analysis of the current price situation can also be found in the In Gold We Trust report 2020. According to the two analysts, gold and silver are targeting significantly higher price regions in the medium and long term. In the short term, however, the potential for further price rises should be largely exhausted, so that a continuation of the consolidation at a high level is the most likely scenario until the middle of summer. Typically, the two markets shake off all weak hands in good time, shortly before the next major wave of rises with a temporary, albeit sharp, setback.

About the In Gold We Trust report

The annual gold study has been written for 14 years by Ronald-Peter Stoeferle and for eight years together with Mark Valek. It provides a holistic assessment of the gold sector and its most important influencing factors, such as real interest rates, opportunity costs, debt, central bank policies, etc. In the previous year, the In Gold We Trust report was downloaded more than 1.8 million times. It is now regarded as the international standard work for gold, silver, and mining stocks. In addition to the German and English versions, the In Gold We Trust report will be published in Chinese for the second time this year.

The following internationally renowned companies have joined us as Premium Partners of the In Gold We Trust report 2020: Agnico Eagle, EMX Royalty, Endeavour Silver, Gold Switzerland, Hecla Mining, McEwen Mining, Austrian Mint, New Zealand Bullion, Novo Resources, philoro Edelmetalle, SolGold, Solit Management, Sprott, Tudor Gold, Victoria Gold und Ximen Mining.

The In Gold We Trust report 2020 will be published in the following editions:

English: Extended Version, Compact Version

German: Extended Version, Compact Version

Chinese: Enhanced Compact Version (to be released in autumn 2020)

All editions of this year’s In Gold We Trust report as well as all reports from previous years can be downloaded at ingoldwetrust.report.

The Authors

Ronald-Peter Stoeferle is Managing Partner & Fund Manager of Incrementum AG.

Previously, Ronald-Peter Stoeferle spent seven years in the research team of Erste Group in Vienna. In 2007 he published his first annual In Gold We Trust report, and it has gained international renown over the years.

Stoeferle is a lecturer at the Scholarium in Vienna and at the Wiener Börse Akademie (the Vienna Stock Exchange Academy). In 2014, he co-authored the international bestseller Austrian School for Investors, and in 2019 The Zero Interest Trap. Moreover, he is an advisor for Tudor Gold Corp. (TUD), a significant explorer in British Columbia’s Golden Triangle, and a member of the advisory board of Affinity Metals (AFF).

Mark Valek is Partner & Fund Manager of Incrementum AG.

Previously, Mark Valek worked for Raiffeisen Capital Management for more than ten years, most recently as a fund manager in the Multi Asset Strategies Department. In this role he was responsible for inflation-hedging strategies and alternative investments and managed portfolios worth several hundred million euros.

Since 2013 he has held the position as reader at the Scholarium in Vienna, and he also lectures at the Wiener Börse Akademie (the Vienna Stock Exchange Academy). In 2014, he co-authored the book Austrian School for Investors.

Incrementum AG

Incrementum AG is a boutique investment and asset management company based in Liechtenstein. Independence and self-reliance are the cornerstones of our philosophy, which is why the five partners own 100% of the company. Before we founded Incrementum, all partners were active for many years in the investment and finance sector in places like Frankfurt, Madrid, Toronto, Geneva, Zurich, and Vienna.

Disclaimer:

This publication is for information purposes only and does not constitute investment advice, investment analysis or an invitation to buy or sell financial instruments. In particular, this document is not intended to replace individual investment or other advice. The information contained in this publication is based on the state of knowledge at the time of preparation and may be changed at any time without further notice.

The authors have taken the greatest possible care in selecting the sources of information they use, and accept (as does Incrementum AG) no liability for the accuracy, completeness or timeliness of the information or sources of information provided or for any resulting liability or damage of any kind (including consequential or indirect damage, loss of profit or the occurrence of forecasts made).

Copyright: 2020 Incrementum AG. All rights reserved.