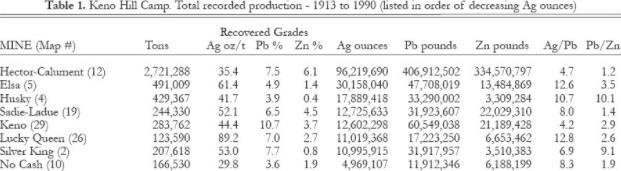

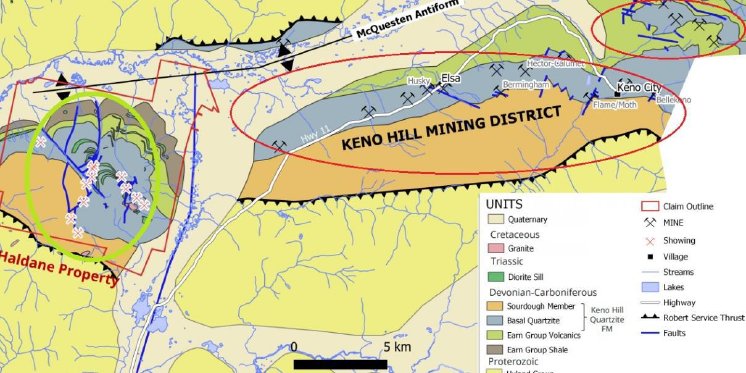

Some smaller mines even had grades as high as 744.3 oz/t Ag (just one vein producing 15 tons of ore in this case), which translates into an unbelievable 23,138 g/t Ag. Such average grades should be regarded unrealistic for the Haldane Silver project, but keep in mind the project is located in exactly the same stratigraphy as these historic mines, as can be seen in the map below.

The company wasn’t just looking at the analogy for a useful geological concept, as the current Phase I drill program was a follow up program around a historic 2011 intercept of 2.2m @ 320 g/t Ag, 1.12 g/t Au, 0.86% Zn and 0.86%. Management also had the UM-02 hole in mind, which is an underground hole drilled in the 60s at Middlecoff, which is the southernmost intersection on the project, generating 1.2m @ 2,791 g/t Ag and 18.7% Pb.

The Haldane property remained very underexplored throughout the years, and has seen very little drilling. When asked about the possible reasons for this, Weber answered: “I believe it to be a combination of distance from the main Keno Deposits/processing facilities, and plenty of available targets close to the processing facilities and time. Because the distance to haul ore from Haldane to Elsa would have been prohibitive in the 1920’s, they would have focused on the area around the Elsa and Keno facilities. There are over 60 deposits in the area so they would have had lots to work on, so why look 20-30km away when you have a highway running through a camp with lots to explore? As time went on the Haldane showings were likely forgotten, hidden on the backside of the mountain, a 10 km drive in. And since the Keno area was largely controlled by

United Keno Hill Mines, who struggled to be economic at times, Haldane was off the radar.”

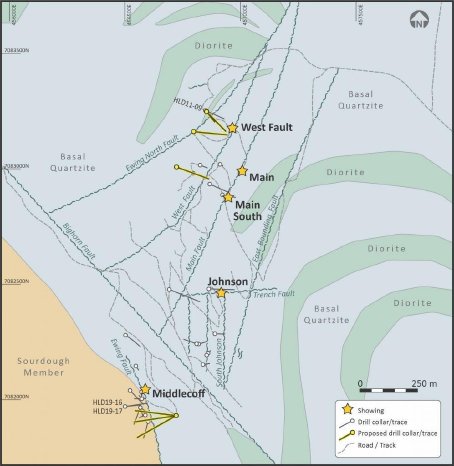

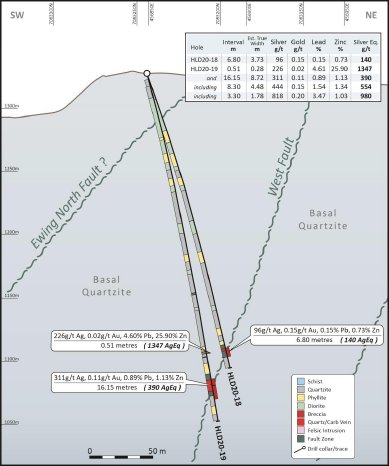

So when the recent news came out on January 28, 2021 of Alianza Minerals drilling a significant 1.78m @ 818g/t Ag within a 8.72m intercept containing on average 311 g/t Ag, 0.89% Pb and 1.13% Zn, or 390g/t AuEq from 247m depth at the West Fault target, it was great confirmation of the exploration potential at Haldane, and the first time the company is looking at truly economic intercepts. For reference, 818g/t Ag translates to 26.3oz/t Ag. As a reminder, here is the map with the planned Haldane Phase I drill hole trajectories:

The small drill program accounted for 4 drill holes totaling 798.6m, 2 holes at the West Fault target and 2 holes at the Middlecoff target, with the last 2 holes still have assays pending one of those holes was terminated after 50m due to excessive deviation. As Middlecoff had 3 holes planned, and the realized location of the holes at the West Fault differed from the map above, Weber explained the first hole at West Fault was supposed to test the Main structure as well, but it steepened up too much making it a very long hole to reach Main, so they terminated it after hitting the West Fault. At Middlecoff they have only drilled the northern-most of the three proposed, and are looking to complete the other two later this year.

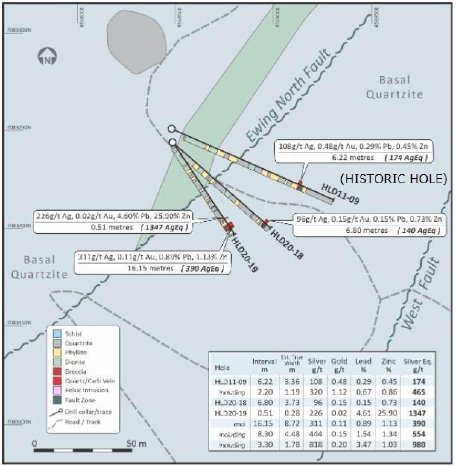

Here is a table of the West Fault results, with HLD20-19 stealing the show obviously:

Please note that the reported intervals are true width as estimated by Alianza Minerals, so it is likely the intervals don’t need to be meaningfully adjusted for this, as is often the case when management doesn’t have a clear view at geology, or leaves the math simply up to the investor. Closing in a bit more on the map for the location of the two recent drill holes HLD20-18 and HLD20-19, following up historic hole HLD11-09:

The 3 holes shown in the map above are just a very small part of the West Fault Structure, which currently is interpreted by management to be over 1,750m in strike length. The recent results caused the company to elevate the West Fault to highest priority target for their 2021 drill program.

CEO Jason Weber was particularly pleased by the width of the intersected vein, as he encountered high grades earlier, but always in a much smaller fashion. As width and grade increased at depth, I wondered if Weber could draw conclusions of this, or that veins by nature could pince and swell like this, without indicating structural controls.

He answered: “These veins do indeed pinch and swell – you are essentially testing the structure 1) for the right mineralogy, which is of course silver mineralization in this case 2) when you have veins with the right mineralogy you can now step out to test for grade and thickness. The Alexco Resource (AXU.TO) crews who are also drilling at Keno Hill were candid that a narrow intersection of the right type can be metres from a thick, high-grade silver zone.” Obviously as the drilling has just begun in this area, the exploration potential is open in all directions.

Weber’s positive attitude is reinforced by the great drill results that Alexco is currently producing at their Bermingham Northeast Deep Zone, which is located in the center of the Keno Hill mining district, in between the old mines. Highlights of their program were 8.76m @ 3,583 g/t Ag, 5.3m @2,070 g.t Ag, 8.15m @ 1,414 g/t, 6.12m @1,560 g/t and 7.46m @1,381 g/t Ag. Alexco is drilling to expand the existing resource of 45Moz @ 844 g/t Ag at depth, and they own several other high grade deposits in Keno Hill, only confirming to Weber that their Haldane location is close to prolific areas. I also noticed that Metallic Minerals (MMG.V) also has a large land package to the east of the historic mines (Alexco in the center, Alianza to the west), and is soon awaiting drill results from a two phase drill program, starting in August and September, completed on December 10, 2020. I asked Weber about their relatively long timeline, and according to him, the assay labs have unprecedented backups these days, so this might be an explanation for their long turnaround time.

Weber is looking to commence the second phase of drilling in April, when the winter break is over in the Yukon. He is planning to do 1,400m spread out over 4-6 holes, for a budget of C$1.2M. Other targets he is planning to drill are Middlecoff and Bighorn but they haven’t decided what holes to drill exactly at this point.

Other active projects of Alianza Minerals are Twin Canyon in Colorado, and Tim Silver in the Yukon. They expect to get a drill permit for Twin Canyon soon, and are looking to find a JV partner who could assist in exploration. The goal is to start drilling in Q3 of this year. Regarding Tim, the operator of the JV Coeur Mining, is planning a reconaissance exploration program starting in Q2, and Alianza is hopeful that the program could lead to drilling at the end of this year.

The current cash position stands at C$2.5 M, and Weber has no immediate plans of raising more capital during 2021.

As Alianza Minerals is focusing on silver at the moment, a precious metal which has recovered nicely from the multi-year long dragging at the bottom, with the absolute bottom reached during the March COVID-19 crash, things are looking fundamentally stronger for the company. Lots of prominent mining investors are focusing on silver and silver equities again, and other, remarkable initiatives are coming into the limelight, as a group of retail speculators is taking on shorting hedge fund managers through coordinated actions on Reddit forums.

Their targets are silver futures and silver equities like First Majestic (FR.TO), one of the most shorted and liquid metal producers around, focusing on silver. As it has nothing to do with fundamentals of silver or related equities, I expect additional volatility. In the mean time, the company is diligently preparing for the upcoming Phase II drill program at Haldane first, and all focus should be on this as only the drill bit is able to create real and lasting value.

Conclusion

Alianza Minerals is, in my view at least, definitely fulfilling the potential it always envisioned at their Haldane Silver project at the Keno Hill District with their latest drill results. Keep in mind that 1.78m @ 818g/t Ag sounds great in itself and is already pretty economic as an intercept, but the current ongoing exploration by peers and historic mine production at Keno Hill point towards more impressive average grades that multiply such results on average 2 to even a staggering 28 times, the last one being for very small historic mines but still an indication of what kinds of extreme mineral endowments have been found in the vicinity.

Therefore I do believe that Alianza might just be scratching the surface IF a Keno Hill style deposit is really present. As the highest grade silver project in the world has an average grade of about 1,150g/t Ag, it might be clear that if Alianza could even remotely match the central Keno Hill grades, it is on to something special. It is my suspicion that since January 28, 2021, the company has appeared on a lot more radars in the mining industry, and deservedly so. Let’s see where this could go from here.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.