1.Introduction

Despite COVID-19 gearing up for a second wave, Standard Lithium (TSXV: SLL) (OTCQX: STLHF) (FRA: S5L) continues to raise money in very significant quantities for a typical lithium developer. I continue to be impressed by CEO Robert Mintak, who raised C$34.5M in December of last year, after completing a heavily oversubscribed C$12.1M round in February of that same year. Although COVID-19 is feared to have an impact on real world economics again, optimism seems to vaporize these sentiments quickly, fueled by a US$900B stimulus package signed by Trump at the last minute on December 27, 2020, and maybe even more importantly, two authorized vaccines, being allocated to front line health care workers worldwide at the moment, and later on to the general public.

Adding to this is the recovery of the Chinese economy, which seems to be immune for second pandemic waves, sending many countries into lockdown again, and is ramping up production and commodity imports to pre-COVID levels, and by doing so seems to function as a kickstarter of the world economy. Following this news were extremely high PMI figures coming in very recently from Europe, indicating strong future recovery sentiments triumphing current lockdown fallouts. I am still amazed by the ongoing disconnection of real world economics and stock markets, as many companies are at the brink of bankruptcy and massive lay-offs, identifying the K-type recovery of stock markets, sending selected stocks to unimaginary and unprecedented highs (Amazon and numerous other internet/delivery companies), while others go down the drain (for example airliners).The remarkable news flow sent stock markets across the globe to multi-year and sometimes all-time highs, and regained enthusiasm for anything Electric Vehicle (EV) related. Tesla boss Elon Musk declared he was going after his own lithium projects last year, and among other things called for nickel contracts. Besides this, as Tesla performed well and locked in 5 quarters of profits, its share price went through the roof.

This all fueled a craze in lithium stocks in the fourth quarter of last year, with supply showing signs of tightening after several years of oversupply and the resulting low lithium product pricing in both spot pricing and contract pricing. A quick clarification: contract pricing is the actual price industrial scale off-takers are paying to industrial scale mining companies for large amounts of lithium products, but the pricing is very hard to track, and spot pricing is the price smaller off-take parties pay to small scale producers, but which is better to track for market watchers like Fastmarkets, Asian Metals and Benchmark Minerals. Like with uranium, another opaque market handling spot and contract prices, Standard Lithium benefitted handsomely as well from the renewed EV interest almost singlehandedly generated by Tesla, as can be seen in their chart:

I must say CEO Mintak has a sixth sense for timing of financings related to COVID-19 outbreaks, as the first raise was closed right before the first wave, and the current one right before the second wave. As it seems Standard Lithium is cashed up now to complete and optimize both the already functional and lithium products producing LiSTR and SiFT demonstraton (pilot) plants, it definitely was time to catch up with Mintak about the current state of affairs.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise

2. Financing

Standard Lithium recently announced the closing of the aforementioned C$34.5M public offering, at a price of C$2.20 with no warrants, which was impressive to say the least, as no lithium junior comes even close. As it was a short form prospectus, there is no holding period, but this didn’t keep the share price from exploding higher. It never dropped to C$2.20 levels after announcing the closing news, which really is a sign of strength. On the contrary, existing warrant holders exercised their warrants to the tune of C$5.5M since October 1, 2020, so the company added about C$40M to the treasury since then.

The net proceeds from the offering will be used to fund ongoing work programs like ongoing testing and optimization work at the SiFT lithium carbonate crystallization pilot plant and the LiSTR Direct Lithium Extraction demonstration plant, preliminary engineering work to advance commercial development of the proprietary lithium extraction process, negotiation and development of a joint venture with LANXESS, and for working capital and general corporate purposes. CEO Mintak was particularly happy to welcome BNP Paribas Energy Transition Fund, which did extensive due diligence before coming on board. It seems everything is back on track and going smoothly, after COVID-19 caused delays in execution over the summer. Even the lithium product prices seem to have just turned a corner, let’s have a quick look for an update in this department first.

3. Lithium product pricing update

I usually use three sources to determine the current state of affairs with lithium product pricing. These are:

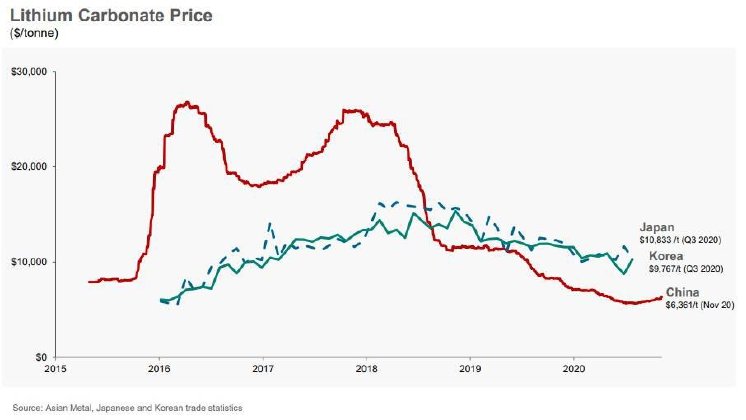

1. Presentation of Lithium Americas, an advanced lithium developer which usually has one or more useful charts on pricing developments to show for:

Please note the signficantly higher pricing out of Japan and Korea, as opposed to China which is leading at the moment for spot prices.

2. Sale prices of Orocobre, an actual lithium carbonate producer, which can be found in their financials (they also have very interesting further information regarding lithium market fundamentals on their website, which is recommended reading material). The H1 FY2020 sales price was US$6,157/t FOB, and the expected Q3 FY2020 sales price was US$5,000/t FOB. However, the realized sales price was just US$3,102/t FOB. Sales volumes were approximately 22% battery grade lithium carbonate and the remainder primary grade lithium carbonate.

3. The monthly update for lithium product pricing and status of lithium developers/explorers, written by fellow writer Matt Bohlsen on Seekingalpha, who continues to diligently track the entire EV suite of metals, and apparently has access to recent available data:

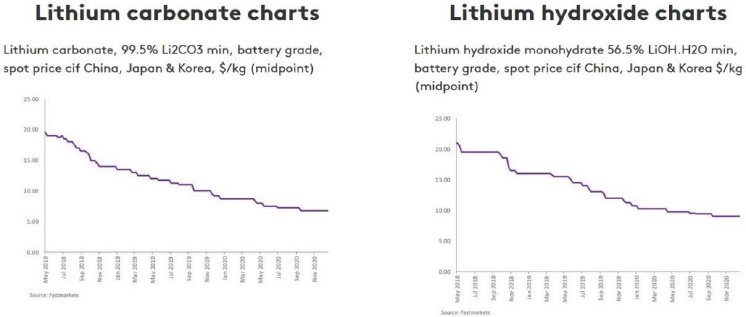

“During December, 99.5% lithium carbonate China spot prices were up 6.4%. Lithium hydroxide prices were up 0.74%. Spodumene (6% min) prices were up 0.21%. Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan & Korea of US$6.75/kg (US$6,750/t), and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan & Korea of US$9.00/kg (US$9,000/t). Benchmark Mineral Intelligence has November global weighted average prices at US$5,700/t for Li carbonate, US$8,837/t for Li hydroxide, and US$380/t for spodumene (6%).”

The trend for lithium products finally seems to have bottomed. This cannot be observed in this latest chart coming from Fastmarkets (paid for link, chart provided by author Bohlsen on Seekingalpha.com):

but when looking more into detail as Bohlsen does, all product prices are going up recently:

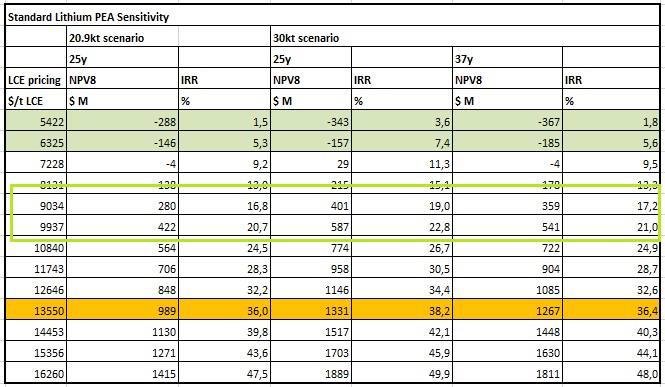

For the long term I have seen market scenarios contemplating US$9,000-10,000/t LCE, which is a price more than half the current development projects need in order to be economic, including in my view Standard Lithium, but we aren’t there yet. Therefore I again reworked the lithium sensitivity, where three scenarios are presented, the 20.9kt LCE pa (per annum) base case, and the hypothetical 30kt LCE pa expansion scenarios as I calculated them in my first article on the company:

A current US$6,200/t LCE price, which is roughly a midpoint of Fastmarkets and BMI estimates, would generate a hypothetical NPV8 of below zero, and a hypothetical post-tax IRR of 5.2-7.3%, which would render the project not economic, as lithium projects usually need an IRR of at the very least 20%. This is something Mintak will address further along this article. As a reminder, these figures are based on 100% project ownership economics, and Lanxess is committed to provide project finance to the JV when testing and the PFS are successful in their view, and Standard will probably be an estimated 30% JV partner. As I am curious about the current state of affairs, especially the status of the PFS, I prepared several questions for Mintak, some are softballs, others curveballs, some fastballs, here we go.

4. Interview with CEO Robert Mintak

The Critical Investor (TCI): Congratulations with the closing of this financing, very impressive. Could you tell the audience how you found BNP Paribas, and are there other new big insto names coming into the story as well, although in that case you are not at liberty to disclose their names? I love the fact BNP didn’t need warrants, but why did you have to do a short form offering without a holding period, was it either warrants or a holding period, and you chose to avoid dilution?

Robert Mintak (RM): While the company has a strong core group of investors that has funded the company when required over the past four years, it has always been our objective to broaden our institutional shareholder base. The recently closed financing was the result of a significant amount of outreach work over the past 6 months. US based Roth Capital Partners, which has covered Standard for several years now, approached us with a brokered offering in early December that aligned with our capital requirements and investor objectives. A short form prospectus offering with no warrant that targeted institutional investors would be the most well received. Echelon Wealth Partners came on as co-lead and both did a terrific job. The financing was well oversubscribed, and we are very happy to have added BNP Paribas ESG focused New Energy Transition Fund as a significant shareholder of the company.

TCI: With this kind of cash on hand, Standard Lithium should be positioned well in order to complete optimization of demonstration/pilot plants and the resulting PFS. I have several questions regarding these subjects. First of all I noticed the news release of December 3, 2020, announcing the successful completion of the start-to-finish proof of concept of the proprietary lithium processing technology: “The culmination of the proof-of-concept was to convert and crystallise the LiCl solution produced by the Company’s first-of-its-kind Direct Lithium Extraction (DLE) Demonstration Plant”. I wasn’t really aware of the need for the conversion of LiCl into battery quality (or even better quality according to the news release) lithium carbonate, in my view this was an option. Focus of attention has always been, as far as I know, the LiSTR DLE Demonstration Plant, which had to produce verification data for the Preliminary Feasibility Study (PFS). Could you elaborate on this news release, and the current strategy of Standard in this regard?

RM: You are correct in that the LiSTR direct extraction technology is the key to unlock the globally significant Smackover lithium resource, and the successful performance of the LiSTR Demonstration Plant is of course paramount, there would be no project without the extractive technology. The LiSTR technology extracts lithium from the Smackover brine in a modern, environmentally friendly, and scalable way. The output from the extraction process is lithium chloride, LiCl. Basically, the same output as the evaporative process. The conversion of the LiCl produced by the LiSTR process to a battery quality lithium carbonate is the broader proof of concept of an integrated lithium chemical project.

TCI: As the 99.9% battery quality lithium carbonate production was achieved on a pilot plant scale, it seems the SiFT system is successful. As you just mentioned a conventional crystallization plant will be the main strategy, does this mean the SiFT system is likely to be integrated at a later stage, assuming it will still be useful?

RM:

I will point everyone to our news release on Sept 9th, 2020 that highlights the Dual Track Program we are undertaking for the conversion of lithium chloride to lithium carbonate. 1. Using an existing conventional OEM process and 2. Utilizing our proprietary SiFT process. Any initial commercial production would utilize an OEM supplied conventional carbonation plant, the SiFT process will continue to be de-risked and proven out for commercial success with a target to be deployed in subsequent stages of the projects development to address the higher purity requirements of next generation batteries.

TCI: The news release further mentioned: “a further concentration using industry-standard reverse osmosis technology” before the LiCl concentrate was converted at the SiFt pilot plant in BC, Canada. Does this mean this is an additional step which will be outsourced in the future, or are you planning on integrating this in the Lanxess project when going into construction?

RM: Nothing will be outsourced. The work that is being done today at different campuses would all be done at the same commercial project location. The concentration of LiCl using a R.O. technology is part of our flow sheet. The R.O. process is a cost-effective step to produce high purity LiCl with optimal concentration for conversion to lithium carbonate.

TCI: Some of the interesting aspects of the LiSTR plant are: it produces lithium chloride (LiCl) directly from un-concentrated raw brine; it reduces recovery time from months to less than a day, and it vastly increases recovery efficiencies to as much as >90%. I was wondering if these objectives are already achieved, or what the status is on each of them as far as you can disclose?

RM: I can only comment on aspects that have been released to the market. What I can state is that we are very happy with the results to date.

TCI: An even more important subject for me is costs as you know, indicating if the recovery process is economically viable at a certain lithium carbonate price or not. I realize this is material information, and we have been discussing optimization in order to lower the PEA base case price for lithium products, but I am still wondering if you could state something in terms of achievements or developing trends?

RM: The purpose of our LiSTR demonstration plant is to prove technical scale up validation, economic process validation and test ways for optimization. Chemical reagents make up 70% of the opex as reported in our PEA, reagent optimization is of course something we are working at improving. I will also highlight the scale of our demonstration plant; 1/60th commercial scale. That may sound small but compare that to any of our peers that operate pilot plants that are typically 1/500th to 1/1000th commercial is size.

TCI: As we have discussed earlier, the PEA uses very high base case pricing for LCE (non-battery quality). Your reaction to the low Chinese spot prices was it wasn’t the correct pricing reported, and we should look at Japanese/Korean prices, which hover around US$9-10k/t LCE. Why is there such a difference in prices between these countries?

RM: Regarding price levels: I strongly believe lithium carbonate prices will return to prices above $13,000 USD per tonne after 2023. It is important to also consider the importance of localizing supply of raw materials. COVID has taught us a lot about localizing supply chains, there are also geo-political considerations and legislative policies that will further define pricing. Look at the USMCA, the United States, Mexico, Canada trade agreement for automobiles. In order for vehicles to qualify, these require 70% domestically North America sourced materials, or suffer from tariffs. From a global perspective, virtually every large car maker has begun making investments and allocating budgets to enter the EV space. The lack of investment in the upstream supply chain for critical minerals will come at a price, a higher price for battery materials.

TCI: Something else. I noticed that you wouldn’t confine yourself to the Lanxess/Arkansas bromine brine feed, but would like to be able to process different brines. How does this work, would you like to review options to export the technology and do JVs with current brine producers worldwide, or is this way too early to contemplate, as the IP is simply owned by the JV in the current Lanxess partnership, and any decision on this will be a joint decision?

RM: The Smackover brine in south Arkansas and to a greater extent the Gulf region is a globally significant resource. Initial commercial production from post bromine extraction tailbrine gets the project up and running quickly compared to any of our peers followed by expansion and decoupling from the bromine tail brine moving westwards across the production fairway. The Smackover brines have the potential to be the Permian Basin of lithium. Our attention will be focused on the lowest hanging fruit and working in the best possible jurisdiction to built a lithium chemical business.

TCI: Going a bit further on IP, it is my understanding that the patents for the LiSTR demonstration plant are still pending. Could you give us an indication when these patents will be granted? Is this in any way a threshold for a potential JV with Lanxess?

RM: The full application of the LiSTR patents was filed in 2018/19 and for multiple countries as required,I really can’t say much on timelines as that is outside of my control. I don’t expect it to be a roadblock for the JV negotiations.

TCI: In case a JV is initiated and finalized with Lanxess, they will be building the project. You have indicated you will be looking at further opportunities, to grow the resource as useful brine runs under the surface for hundreds of miles. How could you monetize an expanding resource, is Lanxess providing expansion capex and returning increased cash flow, how does this work?

RM: I cannot comment on anything that has not been announced or finalized and I can never speak on behalf of our partners. We have been very careful to avoid the problems the industry has faced with developers and even existing producers promising and not delivering. What I will say and I am repeating myself, the Smackover brines are a globally significant lithium resource that, with the application of the appropriate extractive technology and a responsible development strategy offer an unparalleled business opportunity.

TCI: We have come to an end of this interview. Do you have anything else to add for the audience?

RM: After several false starts, the 10’s of billions of dollars committed and billions invested by Auto OEM’s, the legislative policy implementations by governments across the global and a broader acceptance of EV’s by consumers will make 2021 an inflection point in the lithium industry. The timing could not be better for Standard Lithium. We are well funded; have a terrific project partner and we are working in the absolute best place to build a fully integrated lithium project anywhere on the planet. It is going to be an exciting year; we are just getting started.

5. Conclusion

Despite COVID-19 going into its second wave, Standard Lithium raised another C$34.5M, and arrived at the endgame of their optimization process, and according to CEO Mintak, is already into discussions with Lanxess about the intended JV. Lithium product prices finally seem to have turned the corner in conjuction, so the timing is impeccable, combined with Tesla and recovered China car demand, rocking the EV markets and everything connected to it. As a result, the share price of Standard Lithium is going through the roof, although it isn’t exactly clear how to value the company and its project at this point, due to unknown actual cost profiles and opaque lithium contract pricing.

If Mintak is correct and a healthy Japanese/Korean US$10k/t can be used for battery quality lithium carbonate, the Lanxess project is economically viable at the moment if the LiSTR plant opex profile follows specifications laid out in the PEA.

For now, Standard has gathered the data to underpin production costs. It remains to be seen if Lanxess will just finalize a JV or simply could buy Standard Lithium outright, as it would own all IP as well in that case. Either way, it seems Standard Lithium is positioned well these days.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Standard Lithium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.standardlithium.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.