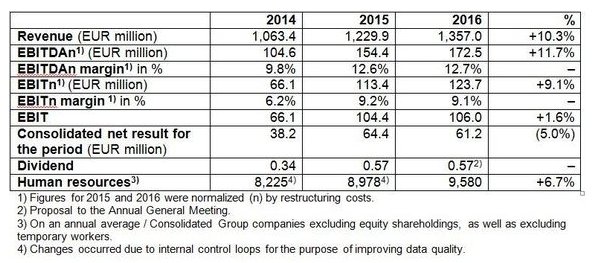

- Revenue grew by 10.3 per cent to EUR 1,357.0 million

- EBITDAn increased by 11.7 per cent to EUR 172.5 million and EBITn by 9.1 per cent to EUR 123.7 million

- EBIT at record level of EUR 106.0 million despite restructuring

- Establishment of marine business as second mainstay after the acquisition of Harding

- Dividend stable at EUR 0.57 per share

- High level of incoming orders in the fourth quarter of 2016 and in early 2017

The PALFINGER Group continued to post further growth in 2016. In the LAND segment, which includes all traditional land-based product areas, growth was recorded in Europe, North America and CIS as well as in the Asia and Pacific region. Following the acquisition of Harding – the largest in the history of PALFINGER – the marine business was bundled in the separate SEA segment. The consolidated revenue recorded by the PALFINGER Group increased by 10.3 per cent to the new record level of EUR 1,357.0 million, as compared to EUR 1,229.9 million in 2015. Despite comprehensive restructuring measures and integration costs in North America and in the marine business, EBIT reached the new record figure of EUR 106.0 million. The management’s focus was on operating profitability normalized by restructuring costs. EBITDAn rose to EUR 172.5 million, corresponding to an extraordinarily high increase of 11.7 per cent, and the EBITDAn margin, at 12.7 per cent, was slightly above the previous year’s level.

“Our successes are the result of the consistent implementation of our business strategy, which has put us in an excellent competitive position. In 2016, we placed a major focus on the expansion of the marine business, to make it the second strong pillar of the PALFINGER Group. Another priority was the increase in operating profitability, which we facilitated by comprehensive restructuring measures in North America and in the marine business. We stand well prepared for the developments that can be expected on the global markets, and we will continue to pursue growth to the best of our ability”, said Herbert Ortner, CEO of PALFINGER AG.

Performance of the segments

The LAND segment comprises the business regions EMEA, the Americas, CIS, as well as Asia and Pacific. This includes all land-based product areas of PALFINGER in these markets: loader cranes, timber and recycling cranes, telescopic cranes, mobile cranes, access platforms, tail lifts, hooklifts, truck mounted forklifts, passenger lifts, bridge inspection units and railway systems.

The satisfactory development in the LAND segment was sustained mainly by the persistently strong demand in the EMEA region – particularly in the core markets and for the core product, loader cranes. All other product areas also made positive contributions to earnings; the Railway Systems unit, the Timber and Recycling Cranes units. In the second half of 2016, the announcement that Great Britain was leaving the European Union was reflected in a decline in business in this market. In Southern Europe the emerging upward trend was confirmed. The establishment of the new company PALFINGER Iberica has already had positive effects.

In North America, 2016 was marked by strong demand, but productivity was not satisfactory. Therefore, PALFINGER initiated a restructuring programme at the beginning of 2016, which is scheduled to be completed by mid-2017. Priorities of this programme include not only an increase in profitability but also the adaptation of the product portfolio. In South America, market conditions remained difficult.

In Russia/CIS, PALFINGER continued to benefit from local value creation. Both demand and earnings were highly satisfactory. The two joint ventures with KAMAZ went into operation in 2016 and have shown positive development ever since. In the Asia and Pacific region, PALFINGER’s business continued to be marked primarily by the cooperation with SANY, which continued to be highly positive. In the course of 2016, the entire value creation, including the assembly of PALFINGER hooklifts, was bundled at the Rudong site.

In the 2016 financial year, the LAND segment generated EUR 1,153.9 million in revenue, corresponding to a 9.2 per cent increase compared to the previous year’s figure of EUR 1,057.0 million. In the reporting period, the LAND segment accounted for 85.0 per cent (previous year: 85.9 per cent) of the Group’s consolidated revenue. The segment EBITDAn (normalized by restructuring costs) saw a significant increase of 18.8 per cent, from EUR 147.9 million to EUR 175.6 million. The EBITDAn margin rose from 14.0 per cent to 15.2 per cent in 2016. Restructuring costs accrued primarily in the region North America for the phase-out of non-profitable products and business divisions and amounted to EUR 9.5 million in the reporting period compared to EUR 6.7 million in the previous year. The segment also recorded an extraordinarily high increase in EBIT from EUR 106.9 million to EUR 128.9 million.

The SEA segment comprises PALFINGER’s maritime product groups: marine cranes, offshore cranes, davit systems, boats, winches and offshore equipment, wind cranes, service, as well as rope access. In order to guarantee the best possible use of synergies in development, production and distribution, the product groups were subsumed into four global product divisions in 2016: Cranes, Winches and Handling Equipment, Lifesaving Equipment and Rope Access.

The low oil price dampened investment propensity considerably in many core customer industries in 2016. Following another price slump in the first half of 2016, signs of stabilization became evident in the second half. PALFINGER recorded a substantial decline in demand in the product division Cranes, with the only positive impact coming from the nascent upturn in the wind industry.

With the acquisition of the globally operating Harding Group effective 30 June 2016, PALFINGER expanded its marine business by adding new products in the field of lifesaving equipment. In addition, PALFINGER now has a global service network. Service is a major factor for success in the marine business, not least because there are strict regulatory provisions. This acquisition represented an enormous growth step at the right time as well as an important strategic development for PALFINGER. Faced with the difficult economic environment and the integration of the Harding Group, PALFINGER initiated comprehensive restructuring measures for this segment in the reporting period. The consolidation of business activities and locations will also help PALFINGER utilize all the potential synergies between the established marine unit and the Harding Group.

Revenue generated by the SEA segment rose by 17.4 per cent to EUR 203.1 million in the 2016 financial year. Since its initial consolidation effective 30 June 2016, the Harding Group has added EUR 45.4 million to PALFINGER’s revenue. In 2016, the SEA segment accounted for 15.0 per cent (previous year: 14.1 per cent) of consolidated revenue. The segment’s EBITDAn (normalized by restructuring costs) declined from EUR 19.9 million in the previous year to EUR 11.5 million in the reporting period. The EBITDAn margin recorded in the SEA segment in the reporting period came to 5.6 per cent, as compared to 11.5 per cent in 2015. The restructuring costs incurred in this segment included primarily acquisition and integration costs incurred in connection with the Harding and TTS projects and amounted to EUR 6.1 million, as compared to EUR 0.7 million in 2015. The segment’s EBIT dropped from the previous year’s figure of EUR 15.0 million to –EUR 3.2 million in the reporting period.

Earnings and dividend

The significant improvement in earnings reported by the LAND segment also facilitated an extraordinarily strong increase at Group level: Normalized EBITDA (EBITDAn) went up by 11.7 per cent, from EUR 154.4 million in the previous year to EUR 172.5 million, resulting in an EBITDAn margin of 12.7 per cent after 12.6 per cent in the same period of 2015. Normalized EBIT (EBITn) increased from EUR 113.4 million to EUR 123.7 million, and the EBITn margin decreased slightly from 9.2 per cent in the previous year to 9.1 per cent. That means that, expressed in absolute figures, PALFINGER was able to improve its operating profitability – normalized by restructuring costs – in the reporting period.

In the reporting period, these restructuring costs came to EUR 17.7 million (previous year: EUR 9.0 million), and were incurred primarily in connection with the initiatives taken in North America and in the marine business.

EBIT thus increased by 1.6 per cent, from EUR 104.4 million to EUR 106.0 million, which marks a new record figure. In contrast, the EBIT margin decreased from 8.5 per cent in 2015 to 7.8 per cent in 2016.

Income tax expense increased due to the expansion of business, coming to EUR 23.9 million in the reporting period as compared to EUR 21.4 million in 2015. The consolidated net result for the 2016 financial year was EUR 61.2 million, 5.0 per cent lower than the previous year’s figure of EUR 64.4 million. Earnings per share came to EUR 1.63, as compared to EUR 1.73 in 2015.

In line with PALFINGER’s dividend policy, the Management Board is going to propose to the Annual General Meeting that a dividend of EUR 0.57 be distributed for the 2016 financial year. For the 2015 financial year, an interim dividend of EUR 0.18 per share and a final dividend of EUR 0.39 per share were paid.

Assets

Primarily in connection with the acquisitions made, total assets increased by 26.7 per cent from EUR 1,212.4 million as at 31 December 2015 to EUR 1,536.3 million as at 31 December 2016. Equity rose by 13.6 per cent from EUR 510.7 million as at 31 December 2015 to EUR 579.9 million. This increase was primarily due to the excellent result in 2016 and was lowered by dividend payments. The equity ratio decreased from 42.1 per cent in 2015 to 37.7 per cent. Non-current liabilities increased from EUR 395.5 million to EUR 525.8 million, while current liabilities rose from EUR 306.2 million to EUR 430.6 million. The primary reason for these changes was the capital required for the acquisition of the Harding Group. 92.6 per cent of PALFINGER’s total capital employed has been secured on a long-term basis.

The purchase prices paid for MYCSA and Harding increased net debt from EUR 347.9 million to EUR 513.1 million. This resulted in a year-on-year increase in the gearing ratio from 68.1 per cent to 88.5 per cent as at 31 December 2016.

Net investments, in the amount of EUR 71.4 million (previous year: EUR 60.4 million), comprised primarily the enlargement of production capacities and replacement investments during the reporting period.

Financial position

In the reporting period, cash flows from operating activities came to EUR 109.6 million, which is approximately the same level as in 2015 (previous year: EUR 110.6 million). The slight improvement in the earnings situation, higher depreciation/amortization due to investments made and a slower inventory build-up had an increasing effect. On the other hand, performance was affected primarily by the decrease in accounts payable and the higher income tax expense. As a consequence of the purchase price payments for the acquisitions, cash outflows from investing activities rose from –EUR 64.6 million to –EUR 187.7 million in the reporting period. As a result, free cash flows amounted to –EUR 68.7 million, as compared to EUR 54.7 million in the same period of the previous year.

Outlook

PALFINGER plans to continue its growth and intends to reach this goal primarily by completing its product portfolio in all regions and by further expanding its marine business. Restructuring measures in North America and in the marine business, which will be completed in 2017, are expected to contribute to a gradual increase in profitability from the second half of the year onwards.

In 2016, PALFINGER took several steps to ensure its continued long-term growth in the future. In the marine business, the focus for 2017 will be on integrating and restructuring the entire unit in preparation for an upcoming upward trend. In addition, further acquisitions are planned in order to complete the product range and make PALFINGER a global leader in all marine product groups. The restructuring measures are scheduled to be completed by mid-2017 in North America as well. In Asia and CIS, market development remains a priority.

Moreover, the group-wide development programmes support the Group’s flexibility and are of great importance with a view to the planned further growth. This includes the focus on current capital reduction as well as on rendering the value creation chain more flexible and advancing the corporate culture. Digitalization will remain a priority.

The comprehensive corporate strategic planning for the period until 2022 will be completed in 2017. It will for the first time also comprise new target ranges for earnings and sustainability goals.

The conditions predicted for 2017 harbour a great deal of political and economic uncertainty. Nevertheless, the management considers further revenue growth to be realistic in light of the satisfactory level of incoming orders in the fourth quarter of 2016 and in early 2017.

The restructuring measures will impact negatively on earnings at the beginning of the 2017 financial year, but are expected to be completed and start showing success in the first half of the year. PALFINGER is aiming to reach a two-digit EBITn margin (normalized by restructuring costs) in 2017.